The Main Principles Of Estate Planning Attorney

The Main Principles Of Estate Planning Attorney

Blog Article

Estate Planning Attorney Things To Know Before You Buy

Table of Contents3 Simple Techniques For Estate Planning AttorneyThe Of Estate Planning AttorneyThe Estate Planning Attorney DiariesIndicators on Estate Planning Attorney You Need To Know

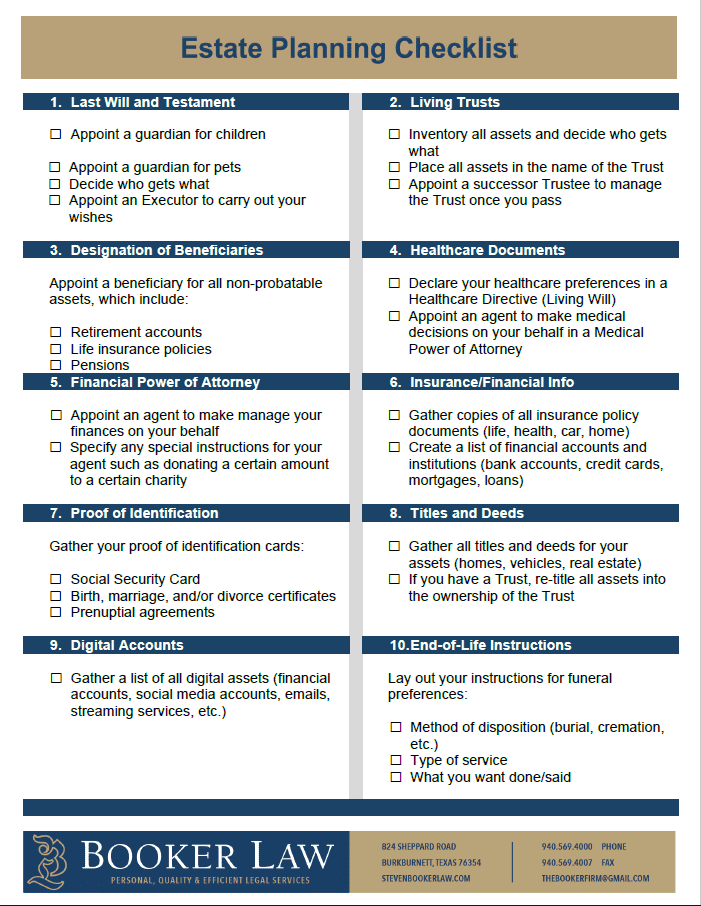

Estate planning is an activity plan you can make use of to identify what occurs to your possessions and obligations while you live and after you pass away. A will, on the other hand, is a legal paper that outlines exactly how possessions are dispersed, that deals with children and pet dogs, and any other desires after you pass away.

The administrator likewise needs to pay off any kind of taxes and financial debt owed by the deceased from the estate. Lenders generally have a restricted quantity of time from the date they were alerted of the testator's death to make insurance claims against the estate for money owed to them. Cases that are declined by the administrator can be taken to court where a probate court will have the final say regarding whether or not the insurance claim stands.

The 5-Minute Rule for Estate Planning Attorney

After the inventory of the estate has been taken, the value of possessions computed, and tax obligations and debt paid off, the executor will then seek authorization from the court to disperse whatever is left of the estate to the beneficiaries. Any estate taxes that are pending will come due within nine months of the date of fatality.

Each private locations their properties in the trust and names someone other than their partner as the recipient. A-B trust funds have actually become less popular as the estate tax exception functions well for a lot of estates. Grandparents might transfer assets to an entity, such as a 529 plan, to support grandchildrens' education and learning.

Fascination About Estate Planning Attorney

This method entails freezing the worth of an asset at its worth on the date of transfer. As necessary, the browse around this web-site amount of possible capital gain at fatality is also iced up, allowing the estate coordinator to estimate their prospective tax obligation obligation upon fatality and better strategy for the payment of revenue taxes.

If enough insurance coverage profits are offered and the plans are properly structured, any kind of income tax obligation on the deemed personalities of properties adhering to the fatality of a person can be paid without resorting to the sale of possessions. Profits from life insurance policy that are obtained by the beneficiaries upon the death of the guaranteed are usually income tax-free.

There are certain files you'll need as component of the estate preparation procedure. Some of the most common ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate preparation is just for high-net-worth people. Yet that's not real. As a matter of fact, estate preparation is a device that everyone can use. Estate planning makes it simpler for individuals to identify their desires before and after they die. Clicking Here In contrast to what many people believe, it extends beyond what to do with assets and obligations.

Not known Details About Estate Planning Attorney

You need to begin preparing for your estate as quickly as you my explanation have any type of quantifiable property base. It's a continuous process: as life progresses, your estate strategy ought to shift to match your circumstances, in accordance with your brand-new goals. And maintain at it. Refraining your estate planning can create excessive economic problems to loved ones.

Estate preparation is frequently assumed of as a tool for the affluent. That isn't the case. It can be a beneficial way for you to take care of your assets and obligations prior to and after you pass away. Estate preparation is also an excellent way for you to set out prepare for the care of your minor youngsters and pets and to detail your want your funeral service and favorite charities.

Eligible candidates that pass the examination will certainly be officially accredited in August. If you're qualified to sit for the examination from a previous application, you might file the short application.

Report this page